10 Simple Techniques For Navigating the Maze of Colorado Medicare Supplement Plans

Deciding on the Right Colorado Medicare Plan: A Comprehensive Guide

When it comes to deciding on a Medicare planning in Colorado, it's necessary to create an informed selection that satisfy your medical care needs. Along with a wide range of choices accessible, understanding the various styles of program and their insurance coverage can be mind-boggling. This complete guide will assist you navigate via the procedure of deciding on the correct Colorado Medicare program.

Understanding Medicare

Medicare is a federal health insurance system that supplies protection for individuals who are 65 years or more mature or those with particular disabilities. It is composed of a number of parts, each dealing with particular services:

1. Component A (Hospital Insurance): Deals with inpatient hospital treatment, knowledgeable nursing facility care, hospice care, and limited property health companies.

2. Part B (Medical Insurance): Deals with physician's gos to, outpatient care, medical source, preventive services, and some home health companies.

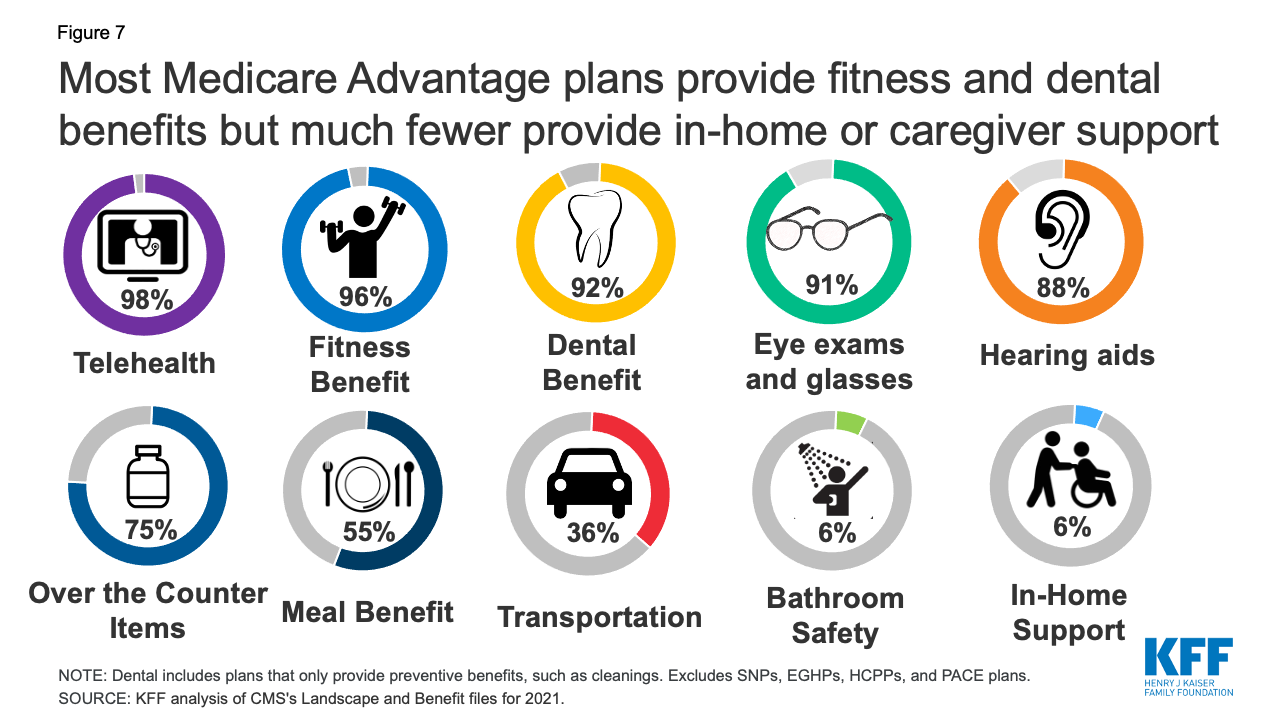

3. Part C (Medicare Advantage): Given through private insurance coverage providers approved by Medicare to provide Part A and Part B benefits. These strategy often include extra advantages such as prescribed drug protection (Part D), dental treatment, eyesight care, and physical fitness programs.

4. Component D (Prescription Drug Coverage): Offers prescription drug protection via personal insurance business accepted by Medicare.

Identifying Your Healthcare Requirements

The first measure in selecting the right Colorado Medicare planning is recognizing your healthcare needs. Take into consideration aspects such as your health care history, any constant disorders you have or medicines you take on a regular basis. Assessing your present healthcare utilization will certainly assist establish which kind of plan would most effectively satisfy your necessities.

Styles of Medicare Plans

1. Initial Medicare (Parts A and B): Original Medicare is supplied straight by the federal government and allows you to pick any kind of physician or medical facility that approves Medicare clients nationwide. While it offers protection for a wide variety of services, it does not cover prescription drugs or very most routine dental or sight care.

2. Medicare Advantage Plans (Component C): Delivered through exclusive insurance coverage business, Medicare Advantage program combine Part A, Part B, and typically Part D coverage right into one planning. These planning might have reduced out-of-pocket costs matched up to Original Medicare but commonly call for you to make use of a system of medical professionals and hospitals.

3. Prescribed Drug Plans (Part D): Prescription Drug Planning give insurance coverage for prescription medicines. More Discussion Posted Here are given by personal insurance policy business permitted through Medicare and may be included to Original Medicare or a Medicare Advantage plan.

Reviewing Planning

Once you've identified your healthcare needs and know the various types of plans readily available, it's time to match up the possibilities. Take into consideration the complying with variables when matching up Colorado Medicare plans:

1. Protection: Review each planning's insurance coverage to make certain it features the companies and medicines you need. Pay out near interest to any kind of restrictions, limitations, or extra benefits used.

2. Price: Compare superiors, deductibles, copayments, and coinsurance volumes for each program. Take note of any out-of-pocket optimum that limit your annual expenses.

3. Provider Network: If you choose for a Medicare Advantage strategy or a Prescription Drug Plan along with network constraints, guarantee that your preferred physicians, hospitals, pharmacies, and specialists are within their system.

4. Prescription Medicines: If you take prescription medications frequently, evaluate each program's formulary (listing of covered medications) to make sure your current prescribeds are covered at an economical price.

Enrollment Periods

Understanding the different enrollment periods is important when selecting a Colorado Medicare planning:

1. Initial Enrollment Period (IEP): This is the seven-month duration that begins three months prior to your 65th birthday party month and finishes three months after it. It is normally encouraged that individuals participate in Medicare during their IEP to steer clear of late enrollment penalties.

2. Annual Enrollment Period (AEP): Likewise recognized as Open Enrollment Period (OEP), this period functions from October 15th through December 7th each year. During the course of this time frame, you may switch coming from Original Medicare to a Medicare Advantage program or bad habit versa.

3. Special Enrollment Period (SEP): Particular lifestyle activities, such as moving, shedding employer coverage, or qualifying for Extra Assistance with prescribed medication expense, might provide you a SEP outside of the IEP and AEP. It allows you to create adjustments to your Medicare planning outside of the standard enrollment time frames.

Looking for Assistance

Picking the best Colorado Medicare program may be frustrating, especially if you're brand new to Medicare. Don't be reluctant to look for assistance coming from professionals who focus in Medicare program and application. Local State Health Insurance Assistance Programs (SHIP) supply free of cost counseling and personalized advice to help you create an informed choice.

In final thought, choosing the ideal Colorado Medicare program needs careful point to consider of your medical care requirements, reviewing various strategy based on coverage and expense, and understanding the enrollment time frames. Through adhering to this thorough overview, you'll be a lot better geared up to decide on a strategy that delivers the essential insurance coverage while fitting within your budget and desires.

Remember that everyone's healthcare needs are special; what works for one individual may not work for another. Take your opportunity in helping make an informed decision that straightens with your certain scenarios.